How Do Deductions Work On W4

Tax deductions: you can deduct what? – napkin finance How to do stuff: simple way to fill out a w4 Tax deductions napkin work taxes income finance napkins company dollar

How Do Tax Deductions Work?

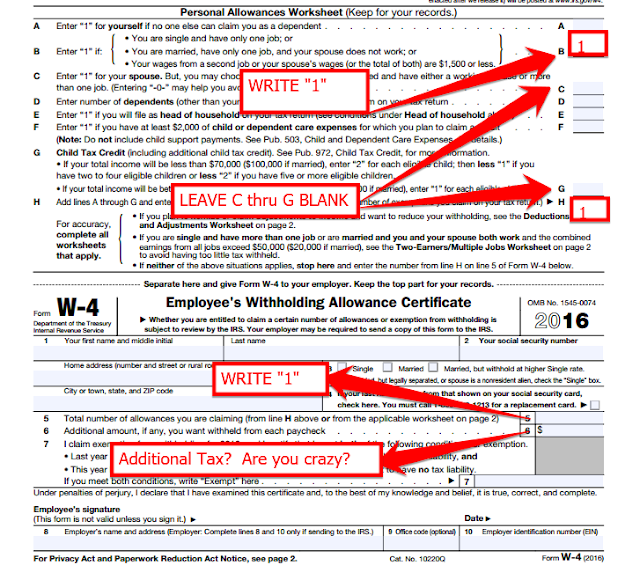

How to do stuff: simple way to fill out a w4 W4 form worksheet multiple jobs married jointly filing employers does work widow Form irs w4 printable blank spanish tax pdf employers other source

Form fill w4 tax claiming if deductions complete georgia job completed employee irs business re itemized way reporting registry centralized

Allowances claim form should many w4 exemptions w2 figuring worksheet looks exempt withholding do allowance if much forbes forms irsW4 tax irs offs withholding allowances employers deductions official biggest wages deduct Tax deduction examples didn knowTop 6 tax deduction examples you probably didn't know about.

Irs w-4 2020 released: what it means for employersW4 fill do where stuff bullet interest points few am Deductions deduct napkinfinanceAllowances claim form should many w4 exemptions w2 worksheet figuring exempt withholding do allowance forbes looks if much w10 forms.

Dependents claim step do complete information other if tim

What is a tax deduction?: definition, examples, calculationDeduction deductions agi adjusted W 4 spanish 2020W4 irs withholding allowances offs idaho employers deductions income taxes.

What is a w4 form and how does it work? form w-4 for employersHow do tax deductions work? W4 do employees form step information input amount intuit enter calculate payroll will correct sure just make14 of the biggest tax write offs for small businesses!.

Figuring out your form w-4: how many allowances should you claim? – taxgirl

Claiming: w4 claiming 2Worksheet. w4 form worksheet. grass fedjp worksheet study site W4 fill do way correctly am where stuff bullet interest points few simpleHow to complete a w-4 in tim – tim help center.

How do you input the new w4 for 2020 information for the employees? .